Should You Switch to a Neobank? The Complete Guide for 2026

5 min read

Updated: Dec 25, 2025 - 12:12:26

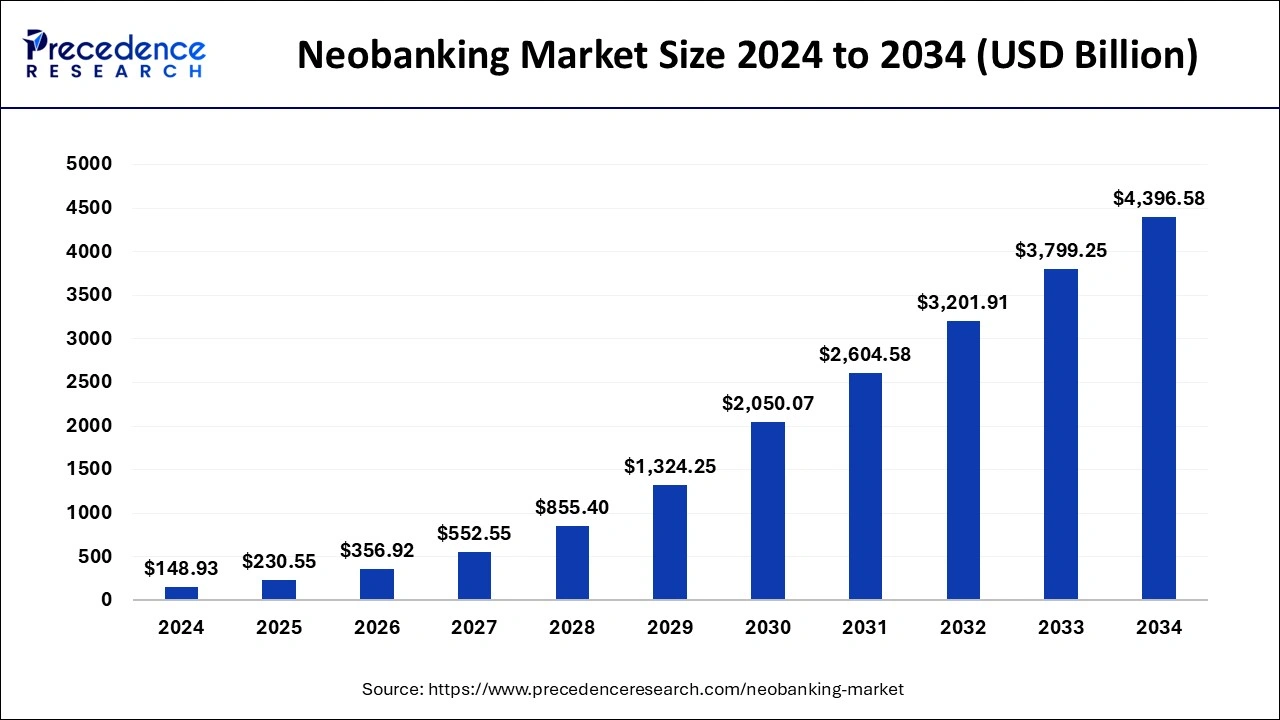

Neobanks, digital-only banks without branches, are growing fast, with the market projected at about $230.55 billion in 2025. They offer high-yield savings (up to 5.00% APY), lower fees, and sleek mobile features, but lack in-person services and some traditional products. Adoption is surging, with over 53 million U.S. adults expected to use neobanks by 2025. Choosing one depends on whether you value tech-driven convenience or still need branch-based services.

- Higher Yields: Top neobanks like Varo offer up to 5.00% APY versus the U.S. average of 0.38% (FDIC).

- Lower Fees: Features like Chime’s SpotMe eliminate overdraft charges and offer early paycheck access.

- Tech-First Experience: Neobanks excel at real-time alerts, instant transfers, and global-friendly features like Revolut’s multi-currency accounts.

- Tradeoffs: No branches, fewer legacy products, and reliance on third-party providers can create risks (e.g., Synapse meltdown 2024).

- Best Fit: Mobile-first, fee-sensitive users benefit most, while cash-heavy or wealth-focused customers may prefer traditional banks.

If you’re frustrated with high bank fees, low interest rates, or clunky mobile apps, you’re not alone. Millions have been trying digital-only “neobanks” that promise lower costs and better tech. Analysts project the global neobanking market to be worth about $230.55 billion in 2025, underscoring just how fast this space has grown.

Source: Precedence Research

What Are Neobanks?

Digital-Only, Branchless Banking

Neobanks operate completely online, through apps or websites, without physical branches. Most don’t hold their own banking licenses; instead, they partner with FDIC-insured institutions to secure deposit insurance via pass-through coverage, provided disclosures and record-keeping are properly maintained.

The Varo Exception

Varo Bank, N.A. became the first U.S. neobank to receive a national banking charter in 2020, granting it more autonomy and enabling it to offer banking services directly to consumers.

Why Consumers Are Flocking to Neobanks

Savvy Savings and Slimmer Fees

Neobanks often offer significantly better savings yields and lower fees than traditional banks. While the average U.S. savings rate hovers around 0.38% APY, top neobanks offer up to 5.00% APY on designated balances; Varo offers exactly that for account holders who meet certain qualifying criteria.

Seamless Tech and Superior UX

Neobank apps typically include:

-

Real-time spending alerts

-

Instant peer-to-peer transfers

-

Early paycheck access, often up to two days early

-

24/7 in-app or chat support

Global and Crypto-Friendly Features

Some neobanks, notably Revolut, cater to international users with multi-currency accounts, interbank-rate FX, and embedded crypto features, all in a sleek mobile interface.

Neobanks You Should Know in 2025

Chime—Everyday Convenience

Chime is one of the most popular U.S. neobanks. Its SpotMe® feature allows eligible users to overdraft up to $200 without fees, based on account usage and deposit history.It also provides early pay options and fee-free access to a network of ATMs, building a compelling everyday experience.

Varo—High-Yield Savings with a Charter

Varo leverages its charter to offer up to 5.00% APY on balances up to $5,000, requiring monthly direct deposits of at least $1,000 and a positive balance to qualify.

Revolut—The Global Player

Reaching over 60 million users in 2025, Revolut stands out for its multi-currency accounts, crypto capabilities, and travel-friendly features.

What Neobanks Don’t Always Do Well

No branches. If you routinely need in-person service or deposit a lot of cash, the branchless model can be inconvenient.

Fewer legacy products. Mortgages, HELOCs, safe-deposit boxes, extensive small-business services, and full wealth management remain the domain of many traditional banks.

Service variability. Digital support is available 24/7 at some providers, but response quality/times vary; this shows up in customer-experience studies year to year.

Dependency on partners and tech. Because many neobanks rely on bank-as-a-service or middleware providers, failures can ripple to end users (for instance, the high-profile Synapse meltdown that temporarily stranded some customers’ access in 2024).

Who Benefits Most?

Neobanks tend to shine for mobile-first, fee-sensitive users who rarely visit branches, want early pay, and value high savings yields and granular app controls.

Adoption is climbing fast: Insider Intelligence projects that roughly 53.7 million U.S. adults will hold digital-only bank accounts by 2025, significantly above earlier estimates.

Who Should Stick with Traditional Banks?

Traditional banks remain a better choice when you need:

-

In-person consultations or cash-intensive services

-

Mortgages, business financing, or trust accounts

-

Private wealth services or cash-handling solutions for businesses

How to Decide (and What to Check)

Before switching, evaluate your specific banking habits and needs:

Your Banking Needs: List which services you actually use regularly versus those you might need occasionally.

Fee Analysis: Calculate how much you currently pay in fees and compare potential savings with neobank options.

Technology Comfort: Consider whether you’re comfortable managing all banking through a mobile app.

Backup Plan: Decide whether you’ll maintain a traditional bank account for certain services or as a backup.

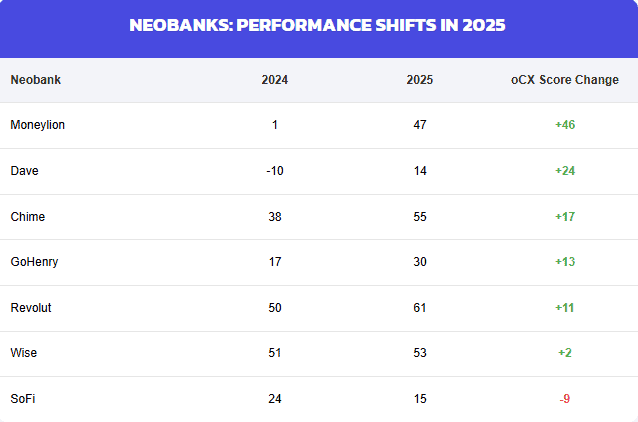

Recent data shows that six out of seven tracked neobanks experienced positive gains in customer experience scores from 2024 to 2025, suggesting the industry is addressing early service issues.

Source: Alterna CX

What’s Next for Neobanks

Expect continued AI-driven personalization, clearer regulatory frameworks around third-party relationships and deposit-insurance messaging, and some consolidation as winners reach scale and profitability.

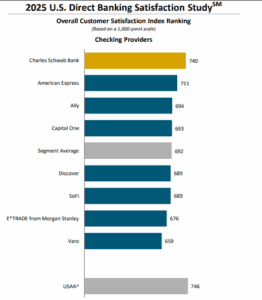

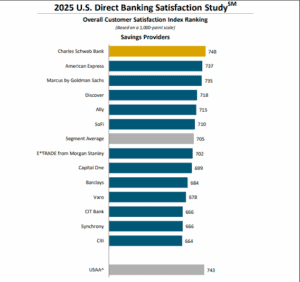

Several leaders abroad are already profitable (e.g., Revolut reported record 2023/2024 profits; Brazil’s Nubank has posted robust earnings), and U.S. direct banks as a group continue to outrun traditional banks on satisfaction.

Source: J.D. Power

Bottom Line

Neobanks are excellent for convenience, cost savings, and modern features. They’re not a universal solution, especially if you want an extensive product suite or frequent in-person service. Many consumers do both: use a neobank for everyday transactions and high-yield savings, while keeping a legacy bank for loans or niche needs.

This topic is part of the broader banking system. For a complete explanation of accounts, transfers, fees, and consumer protections, see our Banking & Cash Management guide.