Binance Restores Yield Products in the UK, Highlighting Regulatory and Investor Risk Considerations

3.8 min read

Updated: Jan 19, 2026 - 10:01:15

On August 14, 2025, Binance reinstated its full Binance Earn suite for UK professional users, following the UK Treasury’s January 2025 clarification that cryptoasset staking is not a collective investment scheme under the Financial Services and Markets Act 2000. This regulatory certainty allows Binance to reintroduce staking, lending, and yield products for eligible professional investors under Articles 19 and 49 of the Financial Promotions Order 2005, excluding retail users. With interest rates easing and staking yields nearing 10%, Binance’s return strengthens its competitive positioning against Kraken, Coinbase, and Crypto.com while offering a compliance framework that could influence global markets.

- Eligibility: UK professional investors only; retail users remain excluded.

- Products restored: Simple Earn, Liquid Staking (WBETH, BNSOL), Crypto Loans, RWUSD, Super Earn, On-Chain Yields, and Soft Staking.

- Market scale: WBETH exceeds $14B market cap; BNSOL TVL over $1.9B across 180,000 users.

- Yield outlook: Staking yields approach 10% annualized as global interest rates ease.

- Strategic impact: Re-entry enhances Binance’s UK market position and sets a compliance playbook for other jurisdictions.

On August 14, 2025, Binance announced the full return of its Binance Earn suite for UK professional users. This follows the UK Treasury’s January 2025 clarification that cryptoasset staking does not qualify as a collective investment scheme under the Financial Services and Markets Act 2000. With this legal certainty, Binance can once again offer staking, lending, and yield-generating products to eligible investment professionals and high-net-worth entities under Articles 19 and 49 of the Financial Promotions Order 2005.

- Eligible users: UK professional investors only, excluding retail users.

- Products restored: Simple Earn, Liquid Staking (WBETH, BNSOL), Crypto Loans, RWUSD, Super Earn, On-Chain Yields, and Soft Staking.

- Market scale: WBETH market cap above $14B; BNSOL TVL exceeding $1.9B across 180,000 users.

- Yield outlook: With interest rates easing, staking yields approach 10% annualized, making crypto income streams more competitive.

- Strategic impact: Re-entry strengthens Binance’s UK position against rivals like Kraken, Coinbase, and Crypto.com, while offering a compliance playbook for other jurisdictions.

On August 14, 2025, Binance announced the restoration of its complete Binance Earn suite for qualifying UK professional users. This development follows a significant regulatory clarification by the UK government, confirming that cryptoasset staking does not constitute a collective investment scheme under UK law.

Regulatory Clarity Enables Product Restoration

In January 2025, the UK Treasury issued a statutory instrument amending the scope of the Financial Services and Markets Act 2000, explicitly exempting cryptoasset staking from the definition of a collective investment scheme. This amendment, effective from January 31, 2025, provides legal certainty for firms offering staking services, enabling them to operate without being subject to the stringent regulations governing collective investment schemes.

Binance’s decision to restore access to its Earn products aligns with this regulatory shift, allowing the exchange to offer services such as staking, lending, and yield-generating products to eligible professional investors in the UK.

Available Products and Eligibility Criteria

The restored Binance Earn suite includes:

-

Simple Earn (Flexible and Locked)

-

Liquid Staking (WBETH and BNSOL)

-

Crypto Loans

-

RWUSD

-

Super Earn

-

On-Chain Yields

-

Soft Staking

Eligibility is restricted to UK professional users, as defined under Articles 19 and 49 of the Financial Services & Markets Act (Financial Promotions) Order 2005. These users include investment professionals and high-net-worth companies, among others.

Market Position and Yield Potential

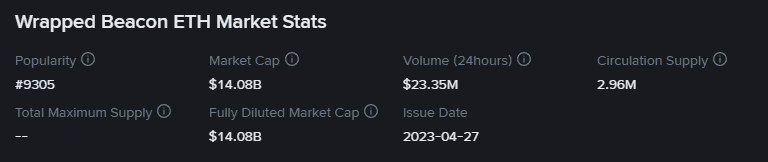

Binance continues to lead in the liquid staking sector. Its Wrapped Beacon ETH (WBETH) token boasts a market capitalization exceeding $14 billion, with a circulating supply of approximately 3 million tokens. The token’s value has experienced significant growth, reflecting strong demand and staking rewards.

Source: Binance

Similarly, Binance’s Solana liquid staking token, BNSOL, has surpassed $1.9 billion in total value locked (TVL), serving over 180,000 users. This positions BNSOL as a dominant player in the Solana staking ecosystem.

With global interest rates easing, staking yields have become increasingly attractive, with some products offering annualized returns approaching 10%. These competitive yields are expected to draw professional investors seeking consistent income streams.

Competitive Landscape and Strategic Implications

The restoration of Binance’s Earn products intensifies competition in the UK’s professional crypto investment market. Competitors such as Kraken, Coinbase, and Crypto.com have maintained staking services for UK users throughout Binance’s regulatory restrictions.

Binance’s comprehensive product suite and market-leading infrastructure provide a competitive edge, despite the professional-only access limiting its addressable market compared to competitors serving retail users.

Looking Ahead: Implications for Global Compliance Strategies

This regulatory development marks a significant step in Binance’s broader compliance strategy. The successful navigation of UK regulatory requirements may serve as a model for similar restorations in other jurisdictions where Binance faces regulatory constraints.

By aligning its offerings with local regulations, Binance aims to expand its services while maintaining compliance with global standards.