Solana Loses Memecoin Crown as Activity Migrates to Rival Blockchains

4.9 min read

Updated: Jan 20, 2026 - 10:01:55

In 2025, Solana (SOL) is losing market share as memecoin trading migrates to BNB Chain and Coinbase’s Base, exposing the risks of relying on speculative token economies. According to Sygnum Bank’s Q3 2025 Crypto Market Outlook, Solana’s revenues “have yet to recover since the Q1 collapse,” while rivals are capitalizing on liquidity programs, developer incentives, and stronger community trust. Standard Chartered warns Solana risks becoming a “one-trick pony,” with 60% of its $3.3B in annual app revenue tied to memecoin dApps, a model vulnerable to boom-bust cycles. Investors should watch for ETFs, staking, and real-world utility as potential catalysts amid regulatory scrutiny.

- BNB Chain surges: Daily DEX volume hit $2.1–$2.3B in March 2025, boosted by a $4.4M Meme Liquidity Support Program.

- Base gains traction: Coinbase’s Layer-2 offers low fees, deep liquidity via Aerodrome, and smooth onboarding for memecoin projects.

- Solana struggles: SOL price down 44.6% in 2025; Pump.fun’s dominance collapsed amid revenue decline and content moderation failures.

- Market contraction: Global memecoin market cap dropped from $127B (Dec 2024) to $56B (Aug 2025).

- Future hinges on utility: ETF resubmissions, staking, and regulatory clarity may redirect flows toward sustainable blockchain ecosystems.

Solana (SOL), once the epicenter of memecoin mania, is rapidly losing market share as speculative token trading migrates to rival blockchains, particularly BNB Chain and Base. According to Sygnum Bank’s Q3 2025 Crypto Market Outlook, this migration marks a significant blow to Solana’s growth and revenue strategy. The Swiss digital asset bank observed that Solana’s revenues have “yet to recover since the Q1 collapse,” raising broader questions about the sustainability of ecosystems built around meme-driven speculation.

The Great Migration: BNB Chain and Base Capitalize on Memecoin Momentum

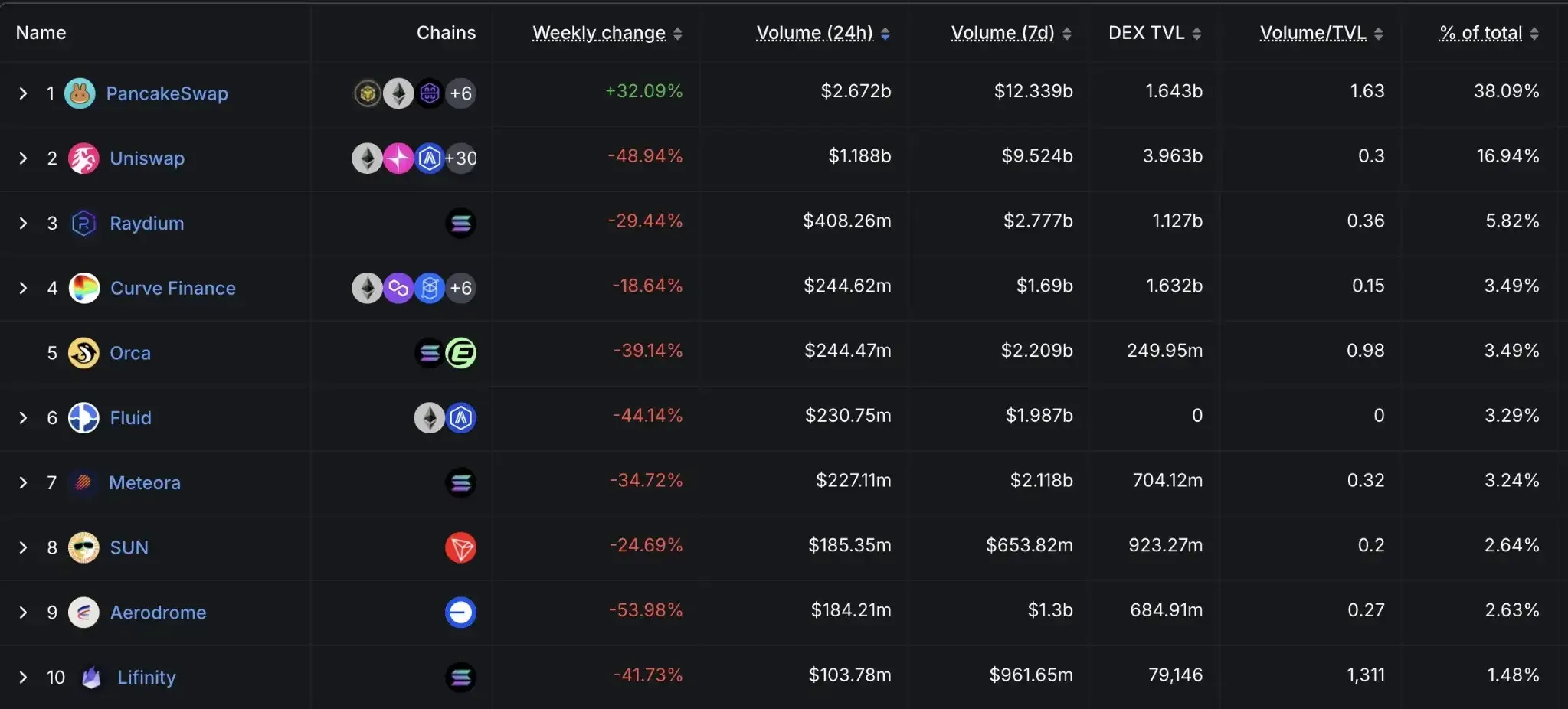

The memecoin sector has experienced a dramatic shake-up in 2025. PancakeSwap, BNB Chain’s flagship DEX, posted over $2.7 billion in daily trading volume in March, briefly overtaking Uniswap as the top decentralized exchange.

Source: DeFiLlama

As reported in March 2025, BNB Chain handled more DEX trading volume than Ethereum and Solana, with daily volume around $2.1–2.3 billion, making it the top-ranked DEX ecosystem globally at the time. Meanwhile, its memecoin market cap surged 48% in a single week to approximately $2.71 billion.

This shift has been fueled by incentives like BNB Chain’s $4.4 million Meme Liquidity Support Program and integration with Binance’s Alpha Program, which nurtures early-stage projects and encourages memecoin issuance. Meanwhile, Base, Coinbase’s Layer-2 network, has quietly become a go-to destination for developers, offering low fees, deep liquidity via Aerodrome, and smooth developer onboarding.

Internal Shift: Let’s Bonk Replaces Pump.fun on Solana

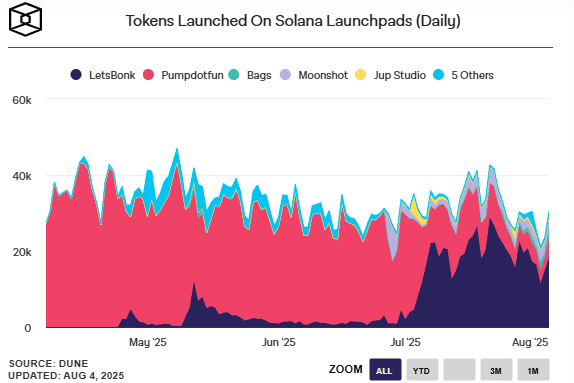

Solana is not just facing external challenges. Within its own ecosystem, a major reshuffling has occurred. The Sygnum report highlights that Let’s Bonk has overtaken Pump.fun as Solana’s top memecoin launch platform. Let’s Bonk’s daily token issuance share skyrocketed from 5% to 64%, while Pump.fun’s share dropped from 90% to 24% in just one month.

Source: The Block

Users have criticized Pump.fun for excessive revenue extraction, while Let’s Bonk appeals to the community with a 30% fee burn model that supports the BONK token and adds deflationary pressure.

Solana’s Financial Struggles Deepen

The memecoin migration has directly impacted Solana’s financial health. Solana’s price is down 44.6% in 2025 from an all-time high of $294 to hit a recent low at $94, and memecoin momentum stalling is one of the reasons.

Source: CoinMarketcap

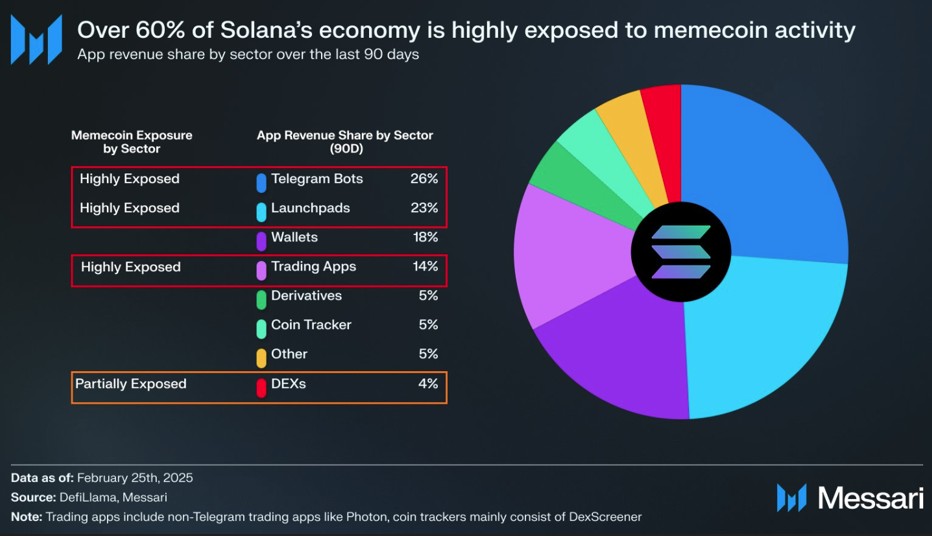

A May 2025 report from Standard Chartered warned that Solana risks becoming a “one-trick pony,” overly reliant on memecoin activity. The bank noted that 60% of Solana’s $3.3 billion annual app revenue was tied to memecoin-related dApps, exposing it to boom-bust market cycles.

Source: Messari

Pump.fun’s Decline and Controversy

Once the undisputed leader in memecoin launches on Solana, Pump.fun is now in sharp decline. The platform’s native token valuation plummeted from $4 billion amid falling revenues and user exodus. The platform also faced backlash over its livestreaming features, which were reportedly used to stream content involving “racial slurs, sexual abuse, threats of violence, and self-harm,” as reported. This content moderation failure further eroded public confidence.

Market Outlook: Risk Remains High

Sygnum warns that the memecoin sector remains inherently unstable. The total market capitalization of memecoins has plummeted from $127 billion in December 2024 to $56 billion in August 2025, based on data from CoinGecko.

As noted in Sygnum’s analysis:

“The highly speculative nature of tokens with no intrinsic value continues to pose a risk as they tend to fuel parabolic rallies that always end in sharp reversals.”

Blockchains chasing rapid fee income from memecoin trading may suffer the same fate as Solana if they fail to pivot toward sustainable economic models.

Future Catalysts: ETFs, Staking, and Real Utility

Despite current challenges, there are glimmers of hope. Solana has gained renewed attention due to ETF resubmissions reportedly including “in-kind redemptions and staking” features, which could attract institutional flows if approved.

However, increased regulatory scrutiny may disadvantage memecoin-centric ecosystems. As global regulators move to classify altcoins based on utility, platforms with non-substantive tokens may lose appeal to long-term investors.

Sygnum concludes:

“As regulatory clarity expands, capital could rotate towards projects with real economic use cases and sustainable token models. Perhaps this shift is already underway.”

Key Takeaways for Investors

Solana’s loss of memecoin dominance underscores a broader truth in crypto: ecosystems built on speculation are vulnerable to collapse. While Solana continues to offer technical efficiency and a vibrant developer community, its dependency on memecoin-generated revenue has now proven a major liability.

For investors and developers alike, the focus is shifting toward real-world utility, compliance, and long-term sustainability. The platforms that successfully transition from meme-fueled booms to utility-based ecosystems are more likely to endure in a maturing market.