Coinbase Posts Strong Profits Amid Trading Volume Decline, Signaling Industry Shift

4.3 min read

Updated: Jan 19, 2026 - 10:01:28

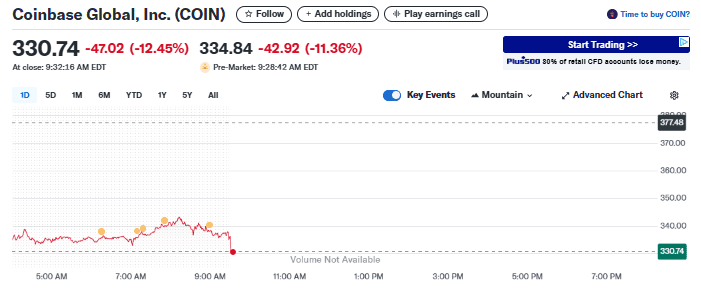

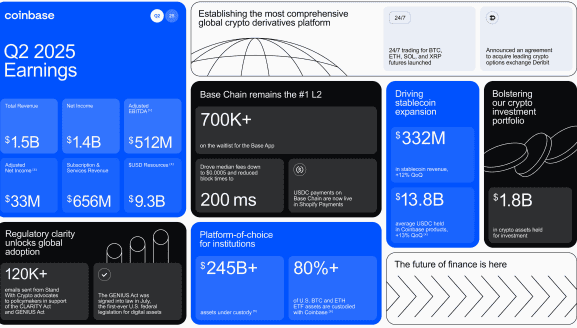

Coinbase Global’s Q2 2025 earnings show the crypto exchange is no longer driven by speculative trading volumes. Despite a 40% quarter-over-quarter drop in total trading volume to $237 billion, Coinbase reported $1.4 billion in net income, supported by investment gains and strong subscription revenue. The company is deliberately transitioning into a multi-service infrastructure platform, emphasizing custody, stablecoins, institutional partnerships, and tokenization, positioning itself as an “everything exchange” for the digital finance era.

- Trading volumes down, profits up: Total trading volume fell 40%, yet Coinbase reported $1.5 billion in revenue and $512 million in adjusted EBITDA.

- Investment gains boosted net income: $1.4 billion net income included $1.5 billion from unrealized gains; adjusted net income was $33 million.

- Recurring revenue growth: Subscription and services revenue climbed to $656 million; stablecoin revenue rose 38% year-over-year to $332.5 million.

- Strategic shift: Coinbase is prioritizing infrastructure, with custody for 80% of crypto ETF issuers, 240+ institutional clients, and a growing Layer-2 network, Base.

- Market context: Centralized exchanges face volume pressure as decentralized exchanges capture 25% share, pushing Coinbase to pursue sustainable models beyond speculation.

Coinbase Global reported a striking Q2 2025 performance, delivering $1.4 billion in net income even as total trading volumes dropped by over 40% quarter-over-quarter. The earnings paint a clear picture: the crypto market is evolving, and so is Coinbase. As speculation fades, the exchange is actively pivoting toward becoming a multi-service infrastructure platform for the future of digital finance.

Source: Yahoo Finance

HODLing Redefines Market Dynamics

Coinbase’s Q2 results reflect the growing “HODL phenomenon,” where investors increasingly prefer to store their digital assets rather than actively trade them. According to the Q2 2025 Shareholder Letter, the exchange’s total trading volume declined to $237 billion, down from $394 billion in the previous quarter. Additionally, crypto market volatility dropped by 16%, further reducing short-term trading opportunities.

Industry-wide trends echo this shift. Spot trading volumes on centralized exchanges have fallen to a four-year low, as confirmed by CryptoQuant. With more tokens being moved to cold wallets and long-term custody, speculation is taking a back seat to strategic holding.

Profitable Despite Market Headwinds

Is Coinbase a good investment now? Despite falling volumes, Coinbase has still reported $1.5 billion in total revenue, just shy of Wall Street’s $1.59 billion target. Crucially, its adjusted EBITDA stood at $512 million, showing strong core profitability even in a more passive market environment.

Source: Q2 2025 Shareholder Letter

However, Coinbase’s standout $1.4 billion net income was largely boosted by:

-

$1.5 billion in unrealized investment gains, including equity holdings such as Circle’s public offering.

-

$362 million in gains from the company’s crypto investment portfolio.

Stripping out these non-operating gains, the exchange posted a more modest adjusted net income of $33 million, providing a clearer view of its operational resilience.

Revenue Over Volume: A Strategic Realignment

Coinbase is consciously shifting away from volume-focused trading models. During the Q2 earnings call, CFO Alesia Haas described the company’s “intentional price change strategy,” which adjusted trading fees on certain stablecoin pairs. The move prioritizes revenue sustainability over market share.

This pivot is already delivering results:

-

Subscription and services revenue rose to $656 million.

-

Stablecoin revenue climbed 38% year-over-year to $332.5 million.

-

The company’s crypto-as-a-service platform now supports over 240 institutional partners, including BlackRock, PayPal, and PNC.

The Exchange Model Is Under Pressure

The broader exchange landscape is also feeling the pressure of shrinking volumes. Despite the generally buoyant mood and Bitcoin gains of 21% year-to-date global crypto trading fell 16% in March 2025, marking the third consecutive monthly drop. Meanwhile, decentralized exchanges (DEXs) now claim a record 25% market share, according to Grayscale.

Market share for centralized giants like Binance, Bybit, OKX, and Coinbase has declined in tandem, despite periods of volatility where overall volumes temporarily spiked. The days of exchanges thriving purely on retail speculation appear to be ending.

Coinbase Builds “The Everything Exchange”

In response, Coinbase is executing a long-term strategy to expand beyond spot trading. CEO Brian Armstrong emphasized the need to become an “everything exchange,” a platform offering a full suite of crypto-enabled financial tools.

Key developments in this direction include:

-

Planned launches of tokenized stocks and prediction markets.

-

Rapid adoption of its Ethereum Layer-2 network, Base, which now has over 700,000 users on its waitlist.

-

Custody solutions for over 80% of crypto ETF issuers and partnerships with more than 150 U.S. government entities, positioning Coinbase as a cornerstone of digital asset infrastructure.

Outlook: Sustainability Over Speculation

Coinbase projects Q3 2025 subscription and services revenue in the range of $665 million to $745 million, reinforcing its belief in recurring revenue models. July’s preliminary transaction revenue of $360 million suggests some stabilization in user activity, although volumes remain below bull market peaks.

Shares of Coinbase fell 7% in after-hours trading following the earnings miss, but the broader story is clear: the exchange is becoming less reliant on trading fees and more focused on building scalable, infrastructure-first solutions for the crypto economy.

Final Take

Coinbase’s Q2 2025 results mark a turning point in the crypto exchange business model. As speculative trading continues to wane, the companies that succeed will be those that adapt to serve the real-world infrastructure needs of digital finance, from tokenization and custody to institutional support and government compliance.

Clearly Coinbase isn’t intent on just surviving the HODL era, it’s shaping what comes next.