Raoul Pal’s Bold Crypto Thesis: Why He’s All-In on Digital

4.6 min read

Updated: Jan 15, 2026 - 07:01:54

When a former Goldman Sachs executive liquidates nearly all traditional investments to bet everything on cryptocurrency, the financial world takes notice. Raoul Pal, founder of Real Vision and Global Macro Investor, has done exactly that, transforming from a traditional macro investor into one of crypto’s most vocal institutional advocates. His dramatic portfolio shift represents more than personal conviction, as it also signals a fundamental reimagining of how wealth should be allocated in the digital age.

The Great Debasement Trade

Pal’s crypto thesis begins with a stark assessment of traditional monetary systems. He argues that unprecedented money printing by central banks worldwide has created what he calls “the great debasement” of fiat currencies. According to Federal Reserve data, M2 money supply has increased by approximately 42% between 2020 and 2025 alone, representing the largest five-year expansion in decades.

Source: Fred (St Louis Fed)

This monetary expansion, Pal contends, makes traditional store-of-value assets like precious metals and real estate inadequate hedges against the pace of today’s currency debasement. His solution: allocate heavily into scarce digital assets, particularly Bitcoin, which he views as “the pristine collateral” for a new financial system.

Pal has publicly stated that he holds approximately 98% of his liquid net worth in cryptocurrency, with the remainder in cash for operational expenses. This extreme allocation reflects his belief that we’re witnessing a historic monetary transition that demands equally historic positioning.

Raoul Pal’s Thesis – Network Effects and Exponential Adoption

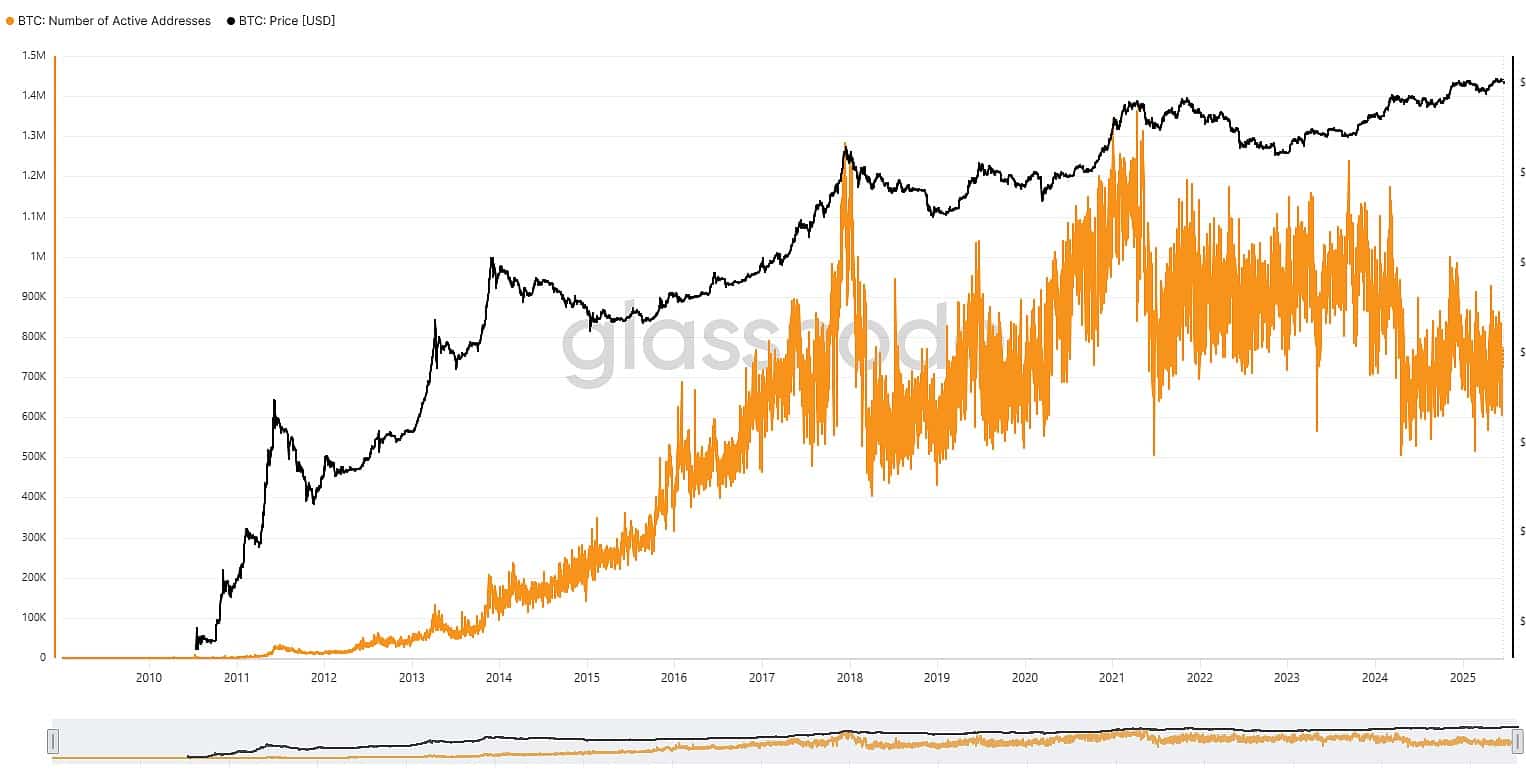

Active Bitcoin Wallets. Source: Glassnode

Central to Pal’s thesis is the application of Metcalfe’s Law, which states that a network’s value increases with the square of its users, to cryptocurrency adoption. He frequently compares Bitcoin’s current adoption curve to the early internet, suggesting that crypto networks are following similar exponential growth patterns. Similar growth curves were seen with mobile phones and personal computers. On-chain data supports this perspective: Bitcoin’s active addresses have grown from approximately 300,000 in 2017 to over 1.2 million in 2021 – but have since slid. Interestingly, this is not an indication of wanning interest, but a reflection of the growing hodling mindset – meaning wallets are not regularly ‘active’.

His analysis extends beyond Bitcoin to encompass the broader crypto ecosystem. Pal views Ethereum as the backbone of a new financial operating system, comparing its smart contract capabilities to the infrastructure layer of the early internet. He’s also particularly bullish on Solana, which is often described as potentially the ‘Visa of the blockchain space’ due to its high transaction throughput.

Institutional Validation and Generational Shift

Pal’s confidence is bolstered by accelerating institutional adoption. He points to companies like MicroStrategy, which has accumulated 601,550 on its balance sheet, and Tesla’s historic Bitcoin purchase as validation of his thesis. These corporate adoptions represent what Pal sees as the beginning of a broader institutional rotation into digital assets.

The generational component of his thesis is equally compelling. Pal argues that millennials and Gen Z investors, who will inherit approximately $174 trillion over the next 25 years, have fundamentally different relationships with digital assets than previous generations.

Survey data supports this perspective: younger demographics show significantly higher crypto adoption rates and view digital assets as legitimate investment vehicles rather than speculative instruments.

The DeFi Revolution and Financial Reconstruction

Pal’s thesis extends beyond simple asset allocation to encompass decentralized finance (DeFi) as a fundamental rebuilding of financial infrastructure. He views DeFi protocols as creating a parallel financial system that offers superior efficiency, transparency, and accessibility compared to traditional banking.

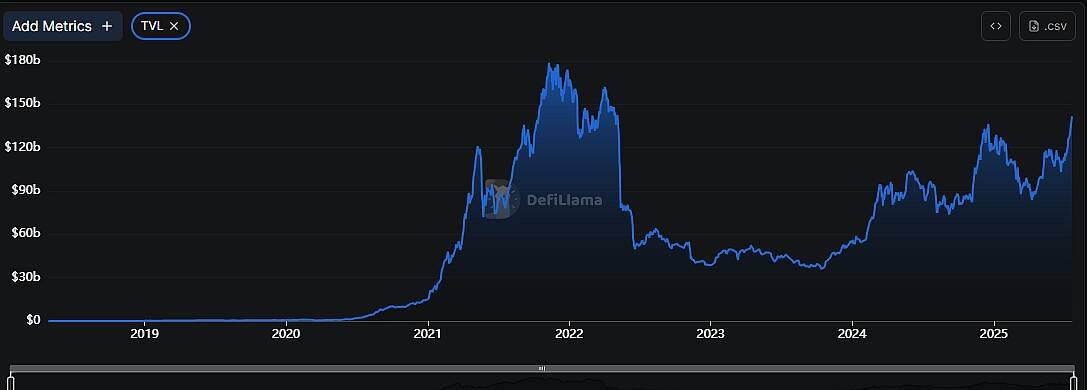

The numbers support his enthusiasm: has grown from essentially zero in 2019 to over $140 billion across various chains today, representing one of the fastest-growing segments in financial services.

Although it has yet to return to its 2022 highs, interest in DeFi staking has been trending up since early 2024. Source: DeFi Llama

Pal particularly emphasizes how DeFi enables global financial inclusion, allowing anyone with internet access to participate in sophisticated financial instruments previously reserved for institutional investors. This democratization of finance, he argues, represents a secular shift that will continue regardless of short-term market volatility.

Regulatory Winds Shift Towards Mainstream Acceptance

With Europe initiating its MiCA regulatory recently, and the US also making its way down the legislative path, Pal maintains that institutional momentum has reached a tipping point and that crypto is transitioning from a fringe asset class to mainstream financial infrastructure. Pal argues that regulatory frameworks, while creating short-term uncertainty, ultimately validate crypto’s permanence in the global financial system. He views regulatory development as a necessary step toward broader institutional adoption rather than an existential threat.

Implications for the Crypto Sector

Raoul Pal’s all-in crypto strategy represents more than individual conviction—it signals a broader institutional recognition of cryptocurrency’s role in portfolio construction. His thesis combines macroeconomic analysis, network theory, and generational trends to argue that digital assets aren’t merely alternative investments but necessary hedges against monetary debasement and technological disruption.

For crypto investors, Pal’s approach offers both inspiration and caution. While his extreme allocation demonstrates conviction, it also highlights the importance of risk management and thorough understanding of crypto fundamentals. His emphasis on network effects, institutional adoption, and generational shifts provides a framework for evaluating long-term crypto investments beyond short-term price movements.

As traditional financial boundaries continue blurring with digital innovation, Pal’s bold thesis may prove prescient—or serve as a cautionary tale about concentration risk in emerging asset classes. Either way, his comprehensive crypto adoption represents a significant vote of confidence in digital asset futures from one of macro investing’s most respected voices.